HSBC Indonesia Mobile Banking

Your financial and banking needs are now more secure, more convenient, and easier. Enjoy the freedom to manage transactions anytime, anywhere with ease.

Take complete control over your finances with a single app, all at your fingertips with HSBC Indonesia Mobile Banking.

Getting started

Step 1

Download HSBC Indonesia Mobile Banking application. Select 'No' to start the registration process.

Step 2

Verify using any of the information you have.

Please note for customers who have

both

debit and credit cards, please use your active debit card number for registration

Step 3

To activate, enter OTP code sent to your mobile number that is registered with the bank.

Step 4

Create username and password to access HSBC Indonesia Mobile Banking.

Do not share

your

information with anyone.

Key features

Monitor the latest transactions from your savings account and credit card anytime and anywhere. And easily manage your payments from monthly bills, credit, to e-wallet balance top-ups. Also learn about other features below.

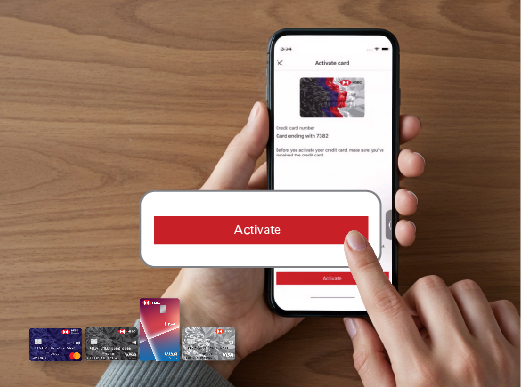

Activate and Manage Credit Card PIN

You can activate your HSBC credit card and manage your PIN easily.

Steps to activate credit card and manage PIN

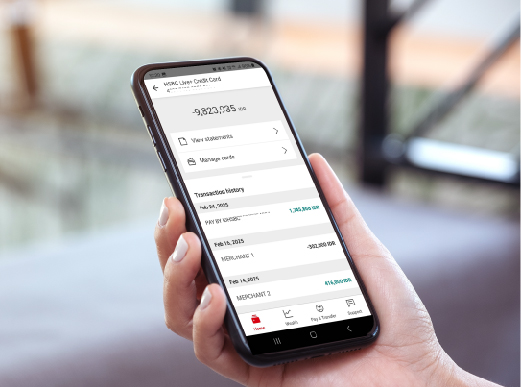

Check Credit Card Transactions with Ease

With HSBC Indonesia Mobile Banking, you can access credit card details such as transaction

history, credit limit, and billing statements - anytime, anywhere.

Steps to access credit card transaction details, limit,

and billing statement

Free Transfers with BI-FAST

Enjoy free interbank transfers with the BI-FAST feature. You can also set a daily transfer limit of

up to IDR 250 million per transaction. Find out more about tariff and transaction fees in HSBC

Mobile Banking here

Steps to transfer with BI-FAST

Enjoy Competitive Interest Rate for Deposits/Savings

Earn higher interest rate (compared to regular savings) with HSBC High Rate Savings Account and

time deposit available in both IDR and foreign currencies.

Steps to open

an HSBC High Rate Savings account

Steps to open time deposit

Seamless International Access

Manage your HSBC account seamlessly across the countries with Global View and Global Transfer

features. Enjoy easy transfers with 12 currencies available in HSBC.

Steps to open a foreign currency account

Start Your Investment Journey Easily

Digital Investment Account Opening (DIAO) helps you to open investment account easily. Fill the

Risk

Profile Questionnaire to assess investment products suitable to your needs.

Steps to open investment account

Steps to fill in risk profile questionnaire

Monitor and Explore Various Investment Options

Experience seamless mutual fund transactions with competitive administration fees, and enjoy a broad

range of options for trading bonds across primary and secondary markets.

Steps to buy primary bonds (e-IPO)

Steps to buy secondary bonds

Steps to buy mutual funds

Upload and Review Investment Documents

You can upload, review, and acknowledge your investment transaction documents through mobile

banking.

Steps to access investment documents

Access Insurance Coverage Summary

Insurance Dashboard feature makes it easy for you to access Allianz insurance policies anytime and

anywhere

Steps to access insurance coverage summary

Why use the app?

Secured

HSBC Indonesia Mobile Banking is accessible only via a single registered device. Even if correct

credentials are used, login attempts from unregistered devices will be denied. Biometric verification is

available to ensure they are conducted by you not someone else.

Lebih lanjut

Convenient

You can manage a wide range of financial tasks, including local and international transfers in 12

currencies, mutual fund investments, bond purchases, and Allianz insurance policies, all from one

app.

Lebih lanjut

Easy

HSBC Indonesia Mobile Banking offers the flexibility to manage your finances anywhere, anytime. Beyond daily transactions, you can also oversee your wealth management.

Download HSBC Indonesia Mobile Banking app

FAQ

About HSBC Mobile Banking

HSBC Indonesia Mobile Banking can be downloaded from App for iOS devices and Google Play Store for Android.

Currently HSBC Indonesia Mobile Banking can be accessed by customers with existing HSBC Indonesia savings account. Features for HSBC credit card-only customers will be updated to the app in the future.

Registration can be done by verifying your data using the information you have, debit card

number, credit card number, or phone banking ID number. For customers who have both debit and

credit cards, please use your debit card number for registration.

Then, please enter

the OTP code sent to the mobile phone number that is registered with the bank. After that,

create a username and password to access HSBC Indonesia Mobile Banking.

Your HSBC

Indonesia Mobile Banking account will be connected to the device you are using and cannot be

accessed from other devices.

You can access banking services on HSBC Indonesia Mobile Banking 24/7, except when system maintenance is ongoing. You may check system maintenance service on logon page in HSBC Indonesia Mobile Banking app.

In profile menu, select Manage security and choose Change PIN. In this menu you can change or reset PIN via HSBC Indonesia Mobile Banking app.

You can use HSBC Indonesia Mobile Banking without using a hard-token device.

Please call HSBC contact centre or visit nearest HSBC branch office

Before binding your HSBC Indonesia Mobile Banking account to a new device, you need to remove your existing device information from the Manage device menu within the app. In case of lost device, please call our HSBC contact centre for device removal assistance before attempting to log on from other device.

You can activate biometrics logon feature on iOS and supported Android devices when you log on for the first time or via Manage security menu within the app.

Language in HSBC Indonesia Mobile Banking app will adhere to the one currently used on your device. To change it, please your device language via device settings.

Log off button can be found on the top right corner of HSBC Indonesia Mobile Banking home page.

You will be automatically logged off from the app after idling for 15 minutes.

Please call our contact centre or visit our nearest branch to get your username.

Mobile banking password is required to access and keeping your HSBC Indonesia Mobile Banking account secure.

After entering your online banking user ID, select 'Password and SMS activation code' as your activation method when prompted. You may be asked to input password directly if you do not have any security device registered. Input your mobile banking password and follow the instruction to send the activation code to your registered mobile number. Once activation code confirmed, your account will be activated on HSBC Indonesia Mobile Banking.

When prompted to input you PIN, select 'Forgot your PIN?' and proceed by verifying your identity with either 'Security code' or 'Password and SMS activation code'. If you choose 'Password and SMS activation code' method, input your mobile banking password and then you will be requested to enter the activation code sent to your mobile number. You will then be asked to create a new PIN.

About HSBC Mobile Banking Features

You can activate your credit cards and manage PIN, check account or card balances, check e-Statements, open savings and deposit accounts, transfer funds (SKN/RTGS/Online Transfer), top up eWallets, and other wealth management features including mutual fund and bond transactions.

To log on into HSBC Indonesia Mobile Banking, you will be prompted to do authentication using hard token or OTP verification to registered mobile number (OTP features to be implemented soon). This authentication process will bind your HSBC Indonesia Mobile Banking account to your current device. While bound to your device, your account can not be logged on from any other device.

Term deposit maturity update function is not available via HSBC Indonesia Mobile Banking at the moment. Please visit nearest HSBC branch office to do this instruction.

You can top up your eWallet using Pay & Transfer menu, and select "Top up eWallet" under transfer type. After eWallet selection, input the your registered number and proceed transfer as usual.

Yes, you can do international transfer using transfer feature in HSBC Indonesia Mobile Banking. You can also transfer to your own international HSBC account using Global Transfer.

Global Transfer supports 12 currencies: AED, AUD, CAD, CHF, CNY, CZK, DKK, EUR, GBP, HKD, HUF, JPY, KWD, NOK, NZD, PLN, SAR, SEK, SGD, THB, USD, dan ZAR. Global Transfer does not support transfer from/to Indonesian Rupiah.

Your internal HSBC account must first must already be linked to your HSBC Indoensia account. At the moment, this linking process can be done via Internet Banking. For linked account, you can directly select your international HSBC account as recipient from beneficiary account list when doing transfer.

HSBC Advance customers will be charged US$ 7 per transfer. For HSBC Premiere customers, Global Transfer is free of charge.

Yes. Indicative exchange rate is displayed real time after you input transaction amount in HSBC Indonesia Mobile Banking. If there is any change in exchange rate before transaction successfully confirmed, you will be prompted to re-confirm your transaction.

Yes, every time you transfer, you can set the transfer date after inputting the transfer amount and beneficiary account number by clicking the calendar icon within the same page.

Yes, you can schedule recurring transfer by activating the Recurring Transfer toggle after inputting transfer aount and beneficiary accout number in the same page.

You can check the scheduled transfer under Managed Future Transfer menu in HSBC Indonesia Mobile Banking.

Yes, under Manage Future Transfer menu, you can choose a scheduled transfer and select Remove button. Removed transfer will disappear from the scheduled transfer list.

About Credit Card Activation and Set PIN

Simply log on to the HSBC Indonesia Mobile Banking app, select your credit card from the account list, tap 'manage cards' and then tap 'Activate' and follow the on-screen instructions.

All of new HSBC credit cards, including cards that are renewed or replaced, can be activated through the HSBC Indonesia Mobile Banking app.

Once you have successfully completed the activation steps, your credit card will be ready to use immediately.

Yes, the primary cardholder can activate their additional cards through the HSBC Indonesia Mobile Banking app.

Log on to the HSBC Indonesia Mobile Banking app, select your desired credit card from the account list, tap ‘manage cards’, then select ‘Set PIN’ and follow the on-screen instructions.

Set/Reset PIN function is available for all of new HSBC credit cards, including cards that have been renewed or replaced, can be activated via the HSBC Indonesia Mobile Banking app.