Income Payout Protector

Protection Solution along with Guaranteed Financial Income

Income Payout Protector

Surely you have various financial plans for family welfare in the future. But is there any guarantee that you will avoid the consequences of risk such as:

The family's financial risk if the breadwinner dies.

Prepare the traditional life insurance product solution with Income Payout Protector for guaranteed financial protection and targets.

Keunggulan Produk

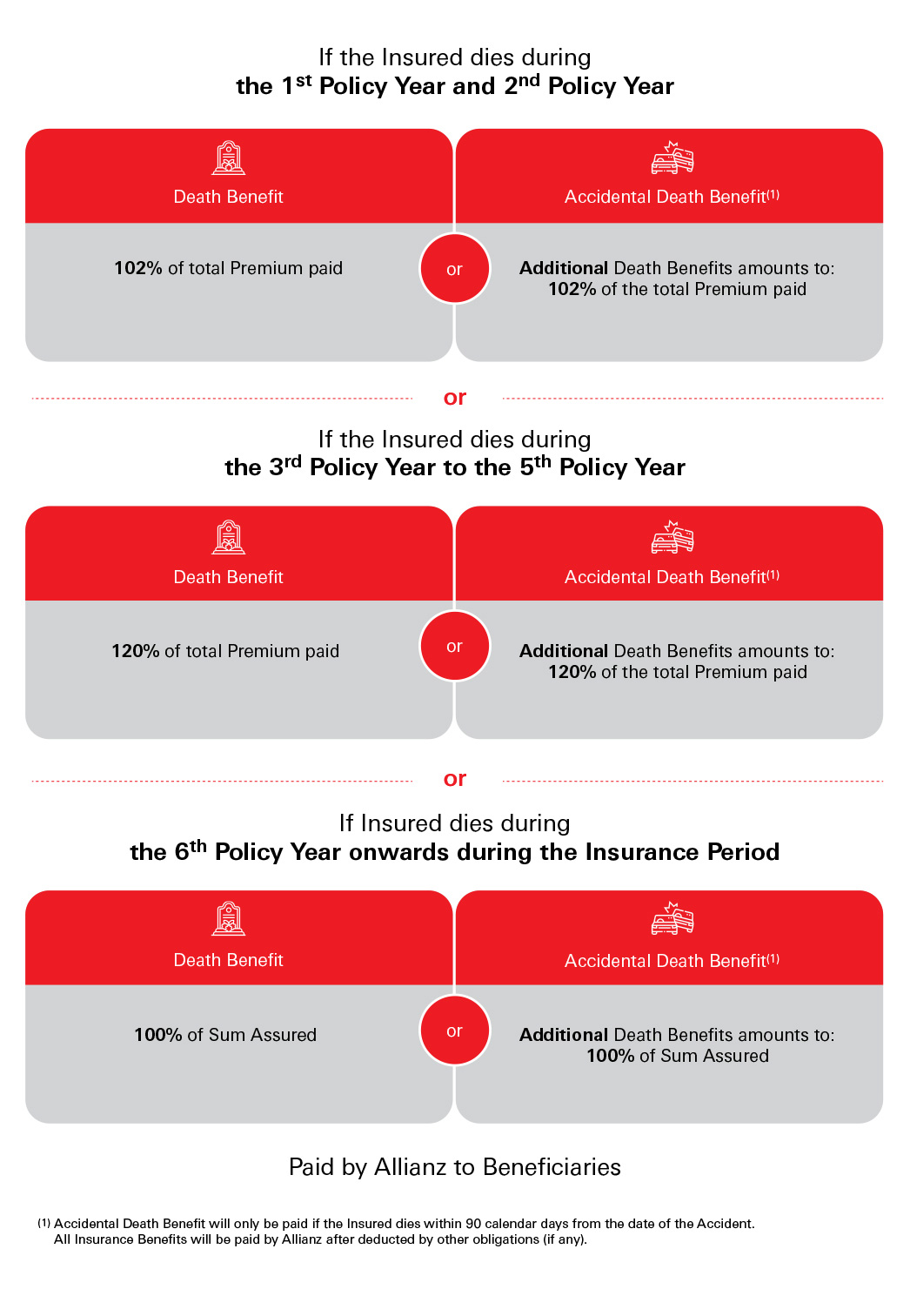

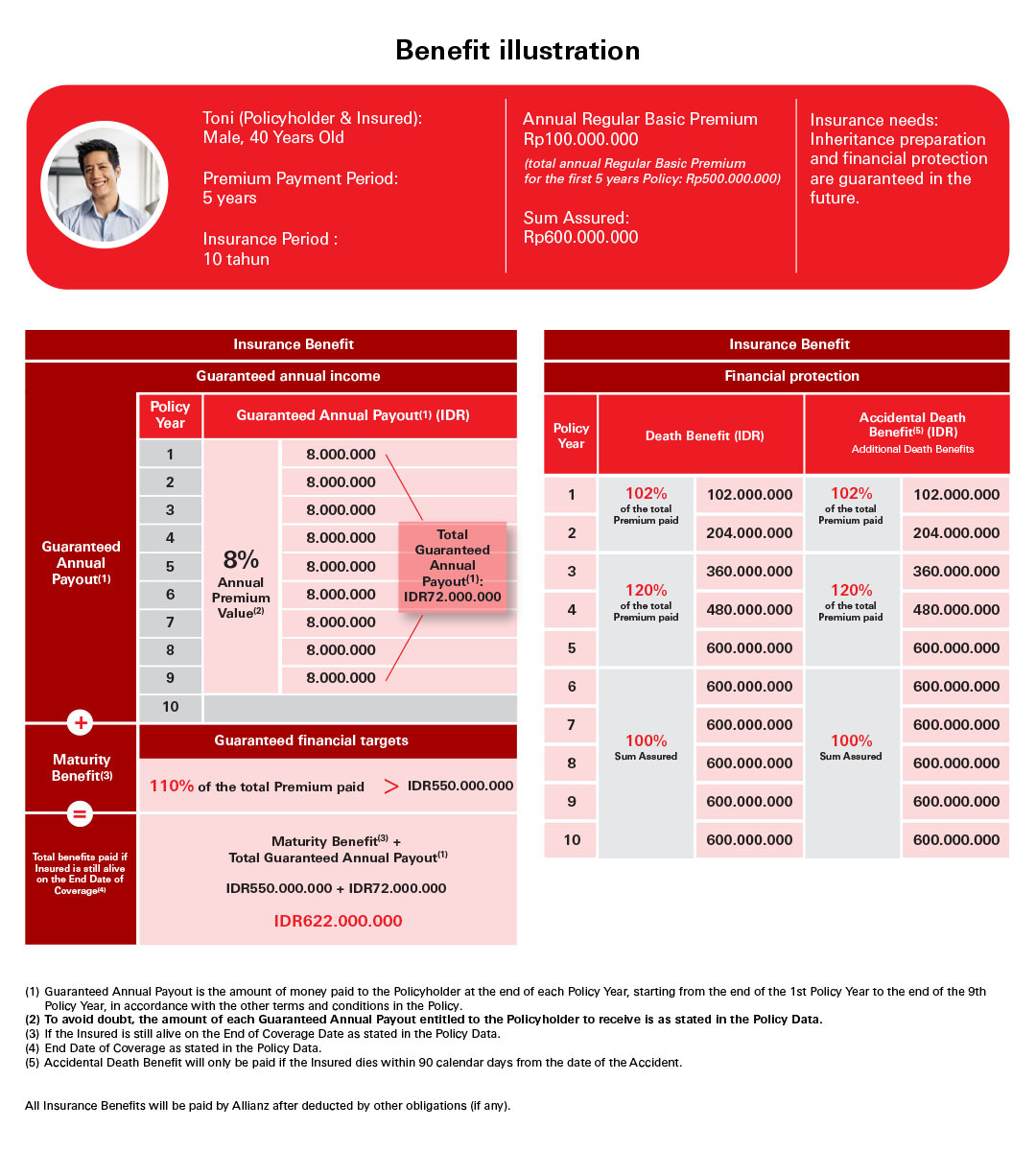

The Death Benefit that Allianz will pay the Beneficiary is 102% of the total Premium paid if the Insured dies during the 1st Policy Year and 2nd Policy Year; or 120% of the total Premium paid if the Insured dies during the 3rd Policy Year to the 5th Policy Year; or the amount of the Sum Assured if the Insured dies during the 6th Policy Year and so on during the Insurance Period.

Accidental Death Benefit(1) that Allianz will pay to the Beneficiary in the form of an additional Death Benefit of 1 times the amount of Death Benefit that the Beneficiary is entitled to receive as referred to in the Policy.

Maturity Benefit(4) that Allianz will pay to the Policyholder is 110% of the total Premium paid.

Short Insurance Period of 10 years with a Premium Payment Period of 5 years.

Apply for a Policy with a health declaration without a medical examination with a maximum Sum Assured of up to IDR 3.000.000.000.

All Insurance Benefits will be paid by Allianz after deducted by other obligations (if any).