Premier Plan Assurance

Allianz - HSBC

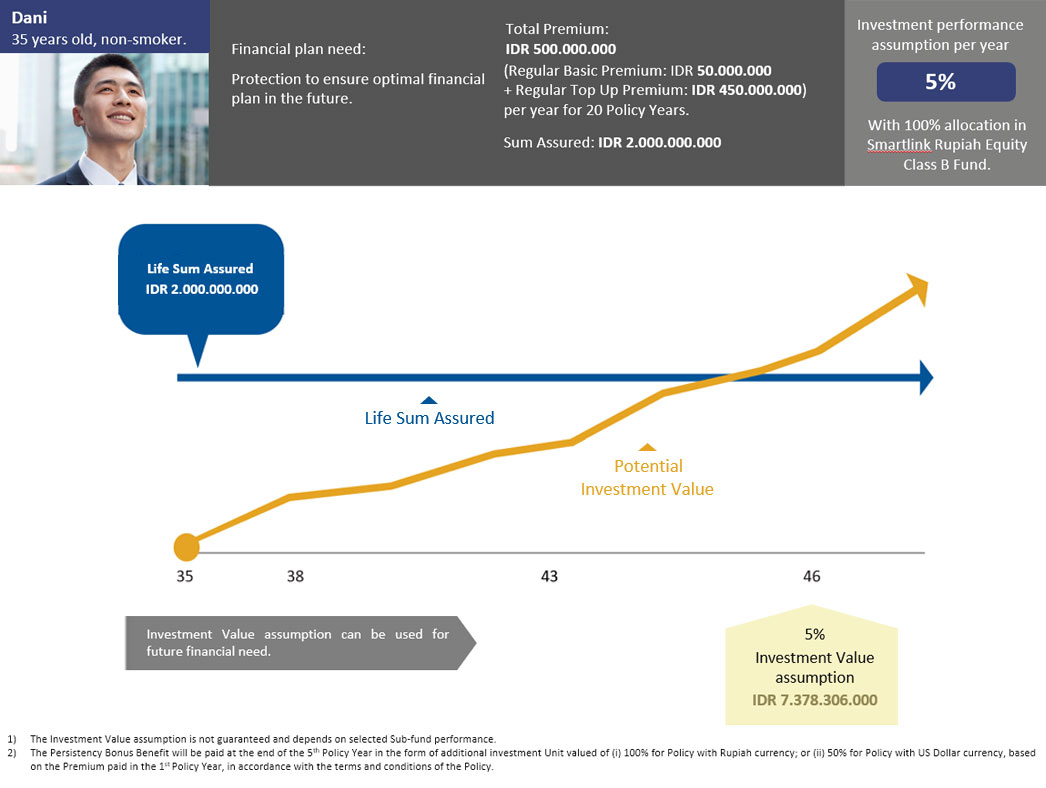

Protection to ensure optimal financial plan in the future.

Premier Plan Assurance

Premier Plan Assurance is a unit link life insurance product that provides protection solutions along with unlocking the potential for optimal long-term investments so that Your future financial plans are protected from various life risks.

Product Highlight

100%(1) Premium allocation from the first Policy Year as Investment Funds(2) for optimal investment growth.

Persistency Bonus Benefit of (i) 100% for Policy with Rupiah currency; or (ii) 50% for Policy with US Dollar currency at the end of the 5th Policy Year(3).

Additional Premium allocation of (i) 103% for Policy with Rupiah currency; or (ii) 101.5% for Policy with US Dollar currency starting from the 6th Policy Year onwards(4).

Optimal Sum Assured for certain entry ages without medical requirements(5).

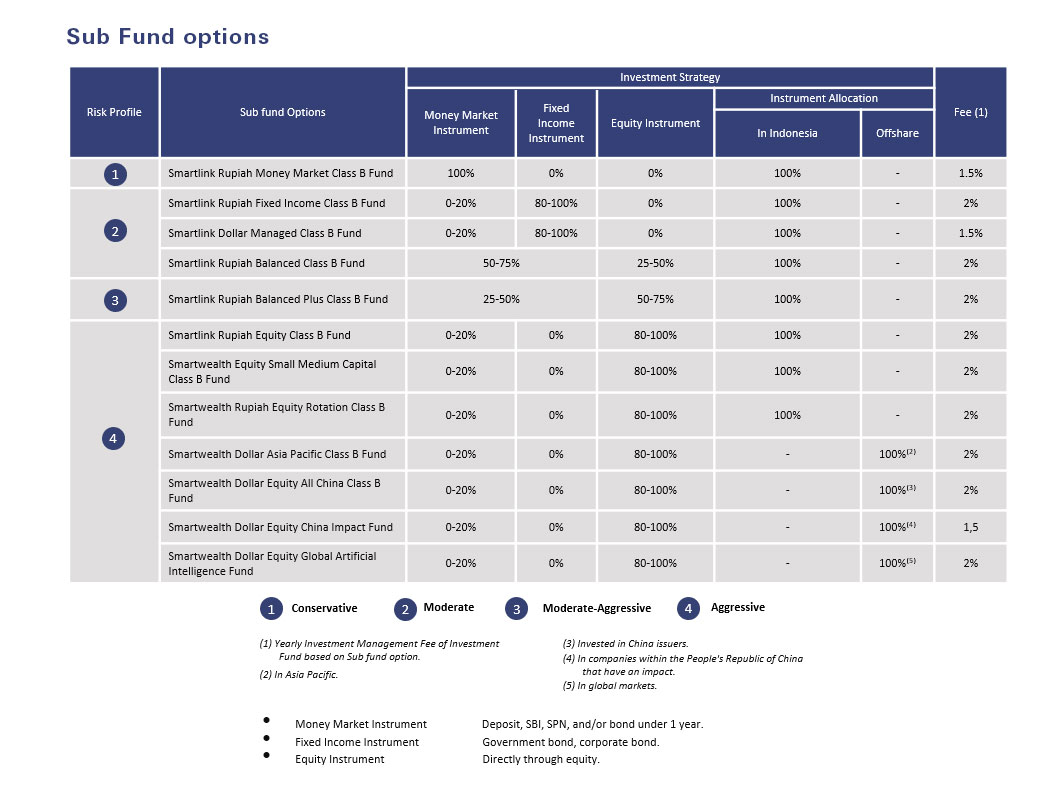

Optimal investment opportunities in Indonesia, Asia Pacific, and Global Markets.

Premium(1) allocation as Investment Fund(2)

Rupiah

- 1st until 5th year : 100%

- 6th year onwards : 103%

US Dollar

- 1st until 5th year : 100%

- 6th year onwards : 101,5%

- The Premium will be automatically allocated as 10% to the Regular Basic Premium account and 90% to the Regular Top Up Premium account starting from the 1st Policy Year onwards.

- The Investment Fund to purchase Unit according Premium allocation on investment based on Policy and Sub-fund choice.

- Insured entry age: 1 month - 70 years old (nearest birthday).

- Insurance Period: Until the age of the Insured is 100 years old.

- In IDR & US Dollar currency.

- Guaranteed Issue (GIO) & Full Underwriting conditions apply based on Policy conditions.

- There are Insurance Benefit exceptions based on Policy terms & conditions.

Note: Effective as of 26 May 2025 subfund Smartwealth Dollar Equity China Impact Fund will be changed to Smartwealth Dollar Equity China Fund