Prime Life Assurance

Solution for your family's future.

Prime Life Assurance

Surely you have various financial plans for family welfare in the future. But is there any guarantee that you will avoid the consequences of risk such as:

- The family's financial condition is not maintained if the breadwinner dies.

Prepare traditional life insurance product solution with Prime Life Assurance for serenity by having optimal legacy.

Product excellence

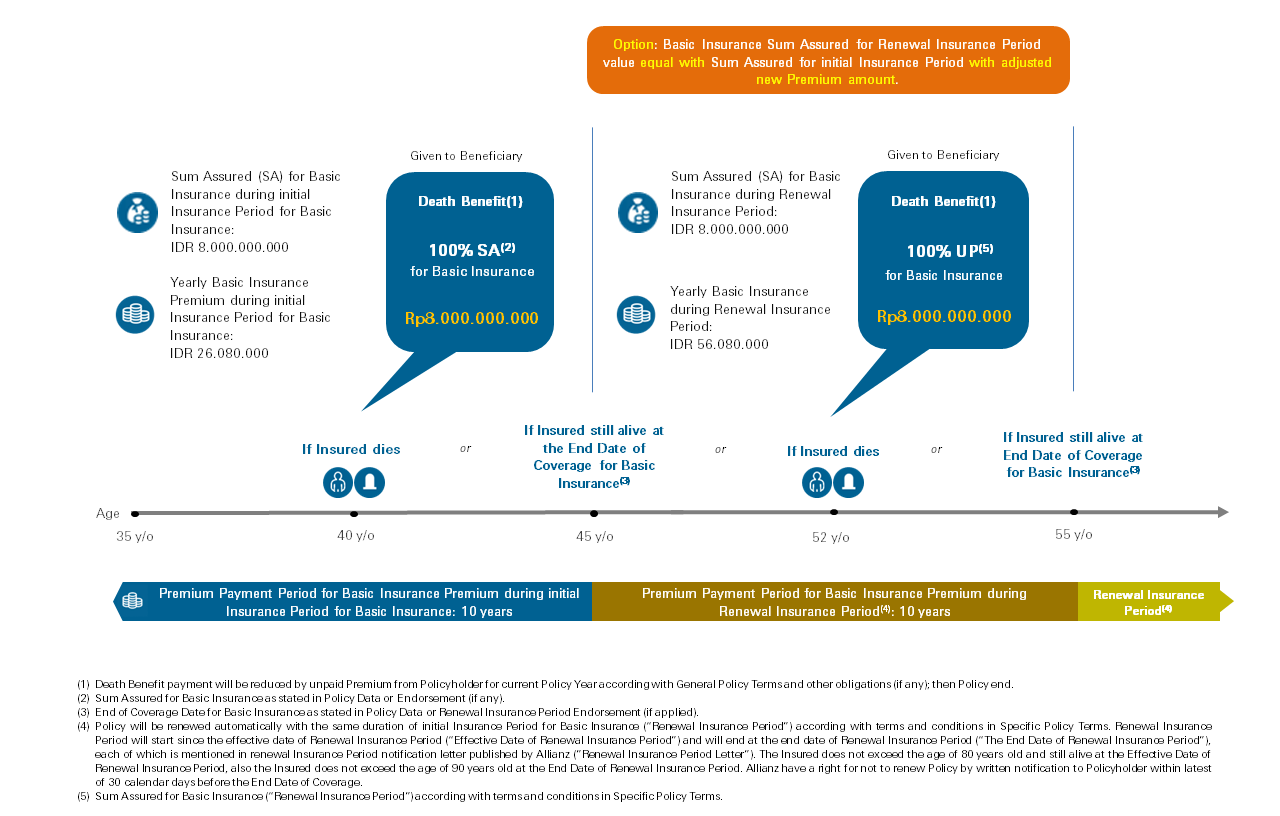

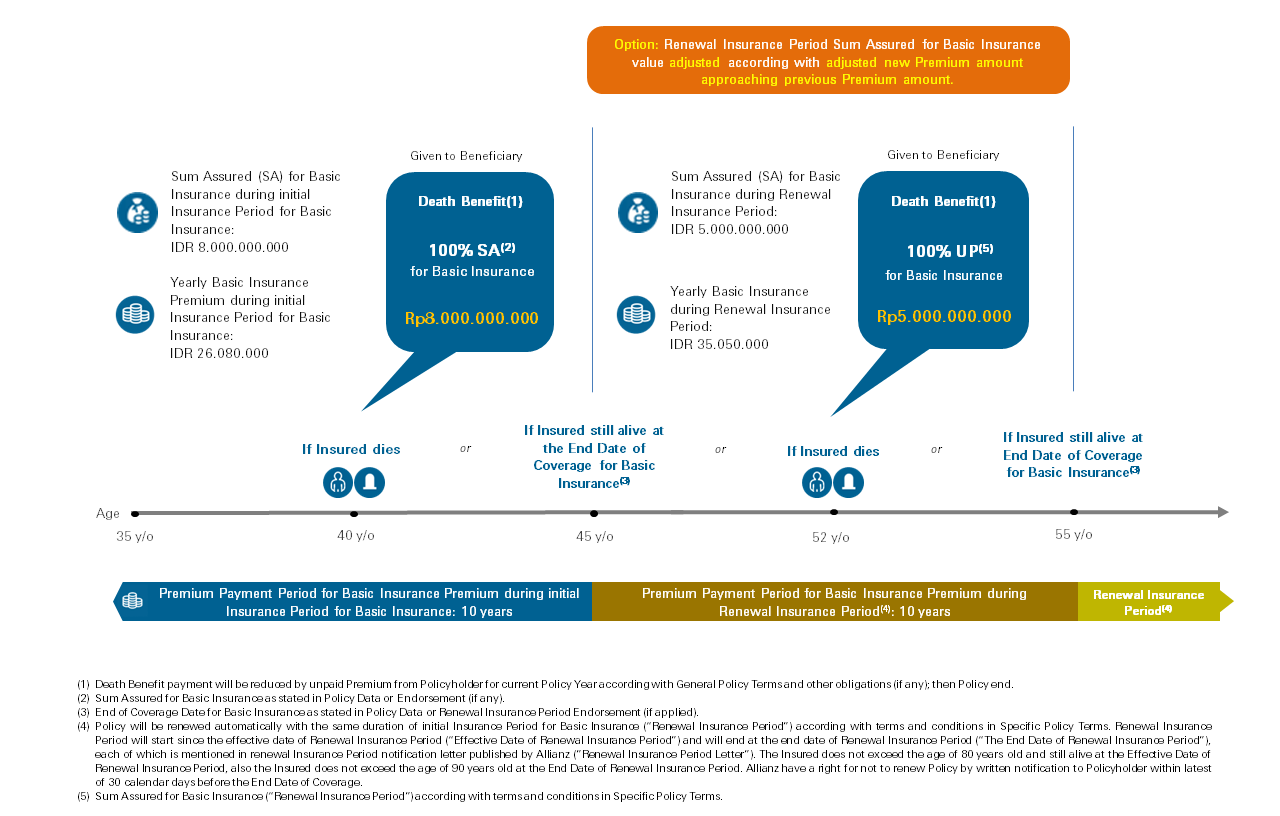

10 years Initial Insurance Period for Basic Insurance with feature of Renewal Insurance Period in the form of Policy will be renewed automatically(3) with the same duration of initial Insurance Period for Basic Insurance(4) without a health check(5).

Maximum legacy with minimum Sum Assured for Basic Insurance IDR5,000,000,000 / USD380,000(6)

Basic Insurance Premium regular payment method in IDR & USD currency based on need.

Insurance Benefit

Specifically for the Insured age below and/or up to 5 years old, Death Benefit will be paid follow to below term:

| Insured age at the time of death (years old) | Death Benefit paid |

|---|---|

| ≤ 1 | 20% |

| 2 | 40% |

| 3 | 60% |

| 4 | 80% |

| ≥ 5 | 100% |

Death Benefit payment will reduced by unpaid Premium from Policyholder for current Policy Year according with General Policy Terms and other obligations (if any); then Policy end.

- Entry age:

- Insured: 1 month - 70 years old (nearest birthday).

- Policyholder: 18 years old - no maximum age (nearest birthday)

- Initial Insurance Period for Basic Insurance:

10 years and :Policy will be renewed automatically* with the same duration as initial Insurance Period for Basic Insurance ("Renewal Insurance Period").

*) If Insured still alive at the End of Coverage Date for Basic Insurance. However, Allianz have a right for not to renew Policy by written notification to Policyholder within latest of 30 calendar days before the End Date of Coverage. - Sum Assured for Basic Insurance:

Minimum IDR5,000,000,000 / USD380,000

Note:- Maximum Sum Assured for Basic Insurance for Insured child (up to Age 17 years old) or non income earner: IDR 8.000.000.000 / USD 616.000

- Sum Assured for Basic Insurance change is not allowed during Insurance Period according to Policy (except option for Basic Insurance Sum Assured for Renewal Insurance Period adjust accordingly with new Premium amount approaching with previous Premium amount).

- Currency: IDR & USD.

- Underwriting: Full Underwriting.

- There are exceptions for Insurance Benefit according with effective terms and conditions in the Policy.

- Premium Payment Method for Basic Insurance Premium:

Monthly, quarterly, semester and yearly.

Notes: Increase or decrease of Premium is not allowed during Insurance Period according to Policy (except adjusted new Premium that must be paid by Policyholder or Premium Payor (whichever is appropriate) based on Insured entry Age according to effective Allianz underwriting terms and Basic Insurance for Renewal Insurance Period Sum Assured value).

- Customer Center Allianz Care:

Call center: 021-1500136

Email: ContactUs@allianz.co.id

Website: www.allianz.co.id - Notes:

Prime Life Assurance is an insurance product issued by PT Asuransi Allianz Life Indonesia and not PT Bank HSBC Indonesia's product. Thus, it is not guaranteed by Bank, and is not included in the government's loan guarantee program or deposit guarantee program.Any information listed in this website is not a part of insurance product policy ("Insurance Policy") and therefore does not constitute agreement for any insurance products between PT Asuransi Allianz Life Indonesia and customers. Customers are bound with terms and conditions listed in Insurance PolicyPT Bank HSBC Indonesia is acting only as reference provider for referensi Prime Life Assurance.