What is the definition of happiness for you?

Whether when enjoying the achievement of your financial security with family, or a rich lifestyle with the best of the best experience. Allianz understands that while enjoying life's success, you certainly need piece of mind for the moment to be timeless. Achieve the serenity through premium protection solutions through Premium Wealth Assurance, so that you and your family continue to achieve the best moments without limits.

About the Product

A life insurance product with regular premium payment through The New Unit Link with efficient protection for optimal investment which preserves the present and future of golden age.

Product Highlight

Sum Assured up to IDR 12 Billion without medical requirement(1).

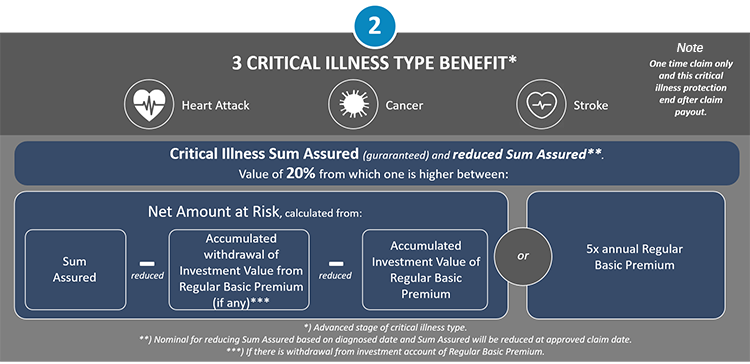

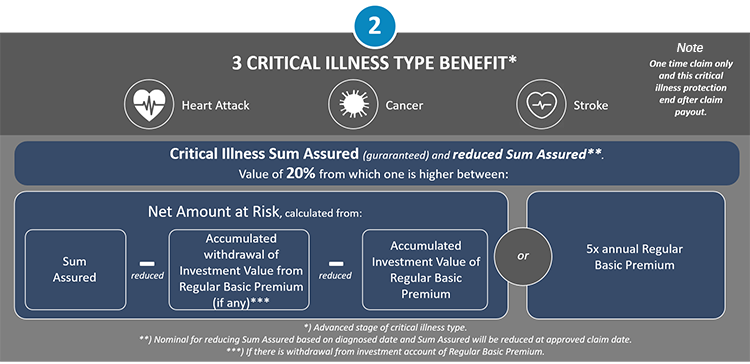

Protection benefit for 3 main critical illness.

Sum Assured value renewal after 3 years since diagnosed with critical illness.

Potential decreased Cost of Insurance(2) for optimal Investment Value growth.

Additional 10% investment allocation since 6th Policy year onwards(3).

70% Persistency Bonus from Basic Regular Premium at the end of 5th Policy year(4).

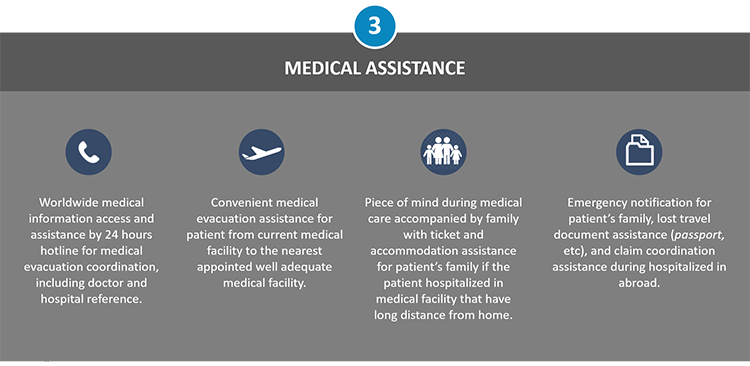

Medical assistant service and evacuation available.

Rupiah & US Dollar currency options available

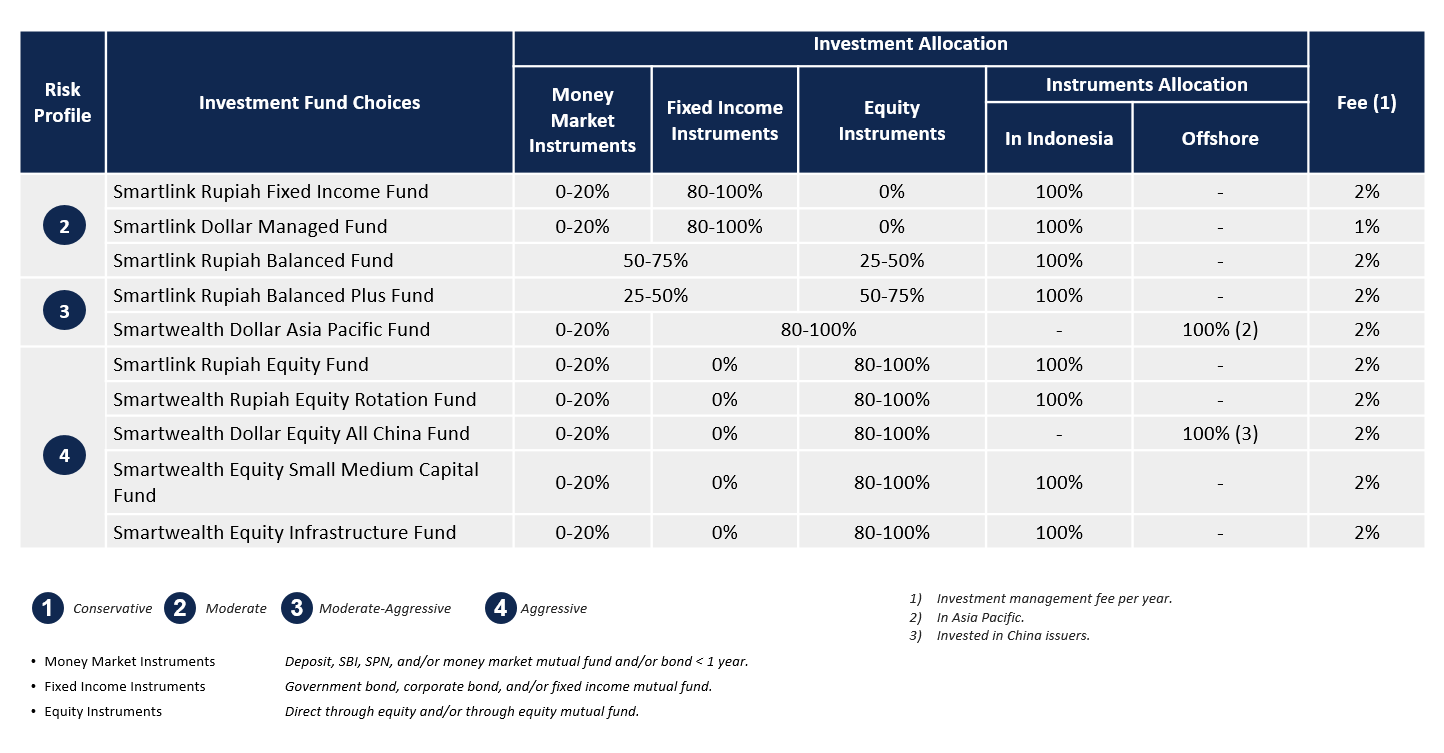

Investment fund options based on market condition in Indonesia, Asia Pacific & global market.

(1) Depends on Insured entry age (based on underwriting terms & conditions applied).

(2) Cost of Insurance adjusted based on Net Amount at Life Risk when Investment Value closer or reach Sum Assured.

(3) Bid/offer spread 5%.

(4) Based on Policy terms & conditions applied.

Product Benefits

Protection Benefit:

Basic Benefit

Protection Benefit:

Additional Benefits (Rider)

- 100 critical illness conditions (CI 100).

- Premium paid by Allianz if Premium Payor diagnosed with critical illness / total permanent disability (Payor Benefit).

Investment Benefit

| Premium Allocation* |

Rupiah |

US Dollar |

| 1st |

75% |

75% |

| 2nd until 5th year |

100% |

100% |

| 6th year onwards |

110% |

110% |

- Maturity benefit: Accumulated potential Investment Value**.

- Potential Investment Value** can be withdrawn based on needs.

*) Bid offer spread 5%.

**) Potential Investment Value is not guaranteed and may change form time to time, depends on investment fund performance.

Persistence Bonus

As appreciation for your consistent basic premium payment, from 1st untuk 60th policy month, enjoy additional investment unit amounted at 70% of your regular basic premium payment* at the end of policy year 5.

*) Annual total of your regular basic premium payment at policy year 1.

**) With condition that regular basic premium is not paid over Premium grace period since 1st policy month until 60th policy month and there was no investment value withdrawal from regular basic premium.

Investment Fund Options

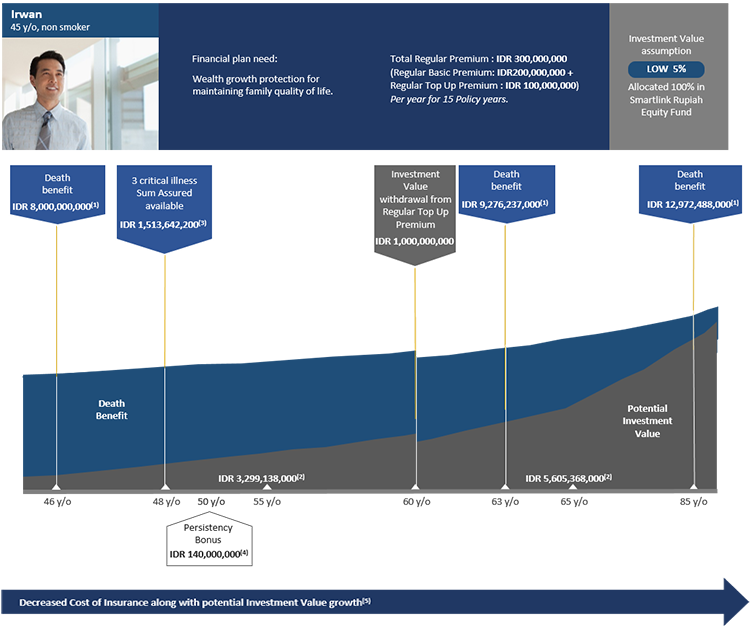

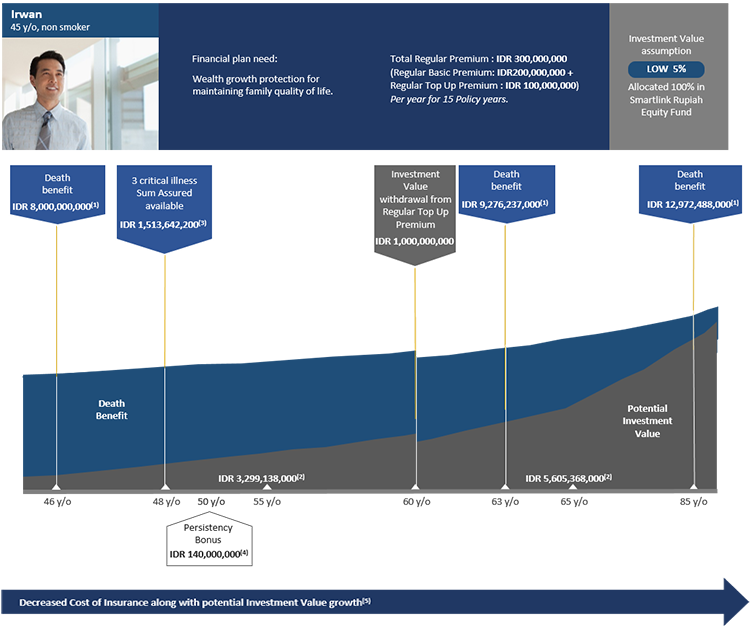

Benefits Illustration

- Death benefit assumption amount is which one higher between Net Amount at Risk or 5x annual Regular Basic Premium added with potential accumulated Investment Value. Death benefit assumption based on selected investment fund performance and Critical Illness Sum Assured claim calculation (CI A3) (if any) or Investment Value withdrawal (if any).

- Investment Value assumption is not guaranteed, depends on selected investment fund performance.

- Critical Illness Sum Assured (CI A3) value of 20% form Net Amount at Risk or 5x annual Regular Basic Premium (which one higher) that reduced Sum Assured.

- Persistency Bonus paid at the end of 5th Policy year in the form of additional investment unit valued of 70% from annualized Regular Basic Premium. With condition that Regular Basic Premium paid not over Premium grace period since 1st Policy month until 60th Policy month and there was no Investment Value withdrawal from Regular Basic Premium.

- Cost of Insurance according to Net Amount of Risk is not fixed and not guaranteed, depends on selected investment fund performance, critical illness Sum Assured claim (if any) or Investment Value withdrawal (if any).

Terms & Conditions

- Insured entry age: 1 month – 70 y/o (nearest birthday).

- Protection period: Until age 100 y/o.

- Rupiah & US Dollar currency options.

- Full Underwriting applied based on terms & condition in Policy.

- Protection benefit exception available based on terms & conditions in Policy.