About Product

Product Benefit

Product Benefit

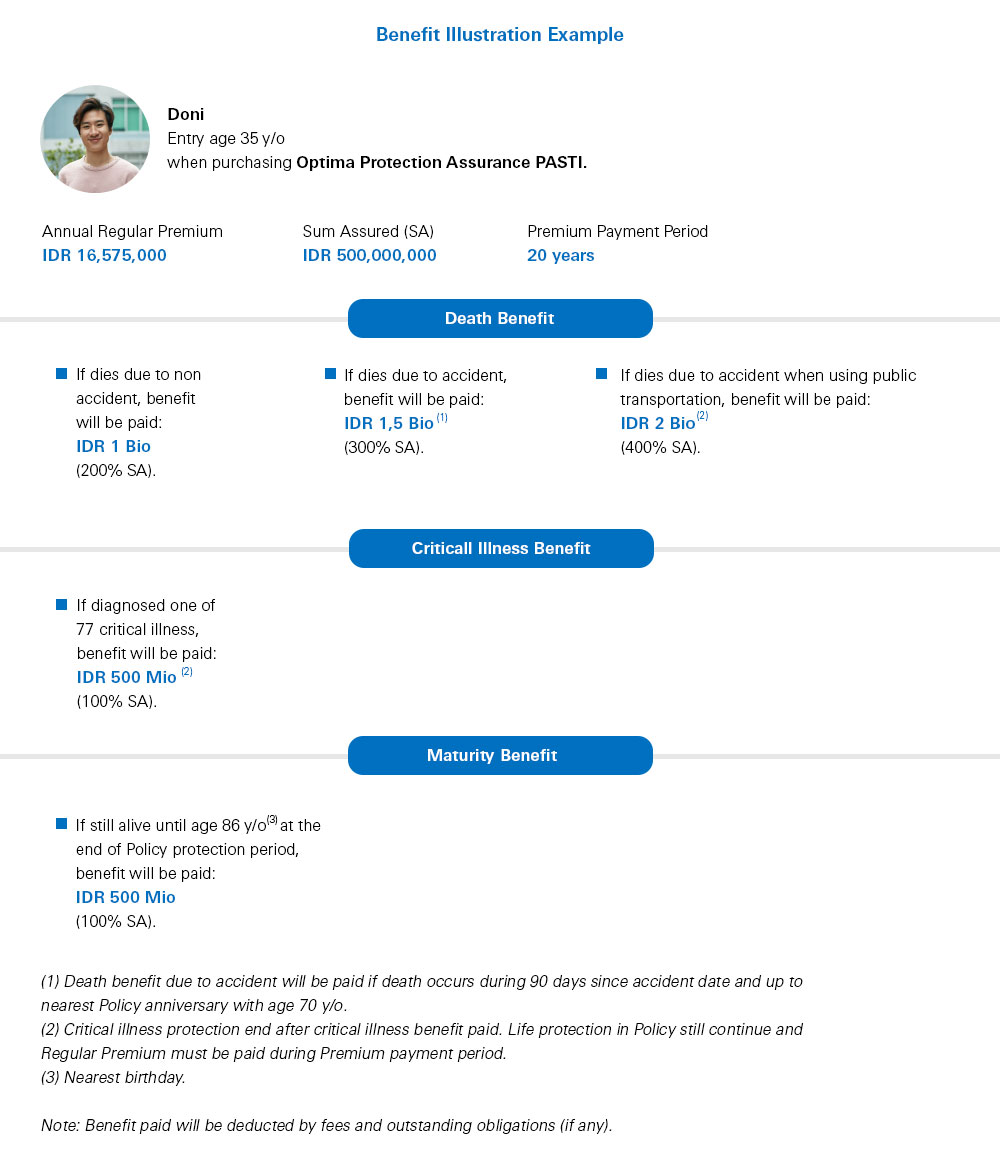

Benefit Illustration Example

Terms and Conditions

Important Notes

Product Brochure - Issued by Allianz

Ringkasan Informasi Produk dan Layanan (RIPLAY) Umum - Issued by Allianz

- Privasi dan Keamanan

- Ketentuan Penggunaan

- Kebijakan Hyperlink

- Keamanan Online

- PT Bank HSBC Indonesia is licensed and supervised by the Financial Services Authority (OJK).

- This product is an insurance product issued by PT Asuransi Allianz Life Indonesia. This product is It is not guaranteed by the bank and is not covered by the government deposit guarantee program (Lembaga Penjaminan Simpanan).

- Bank only assumes the limited role of transmitting the information from the insurance company of the products to customers; or to provide access for insurance companies to offer insurance products to its customers. Insurance is not a bank product.

- Pertanggungan menjadi tidak berlaku apabila ada hal-hal yang termasuk dalam pengecualian sebagaimana tercantum dalam polis (risiko produk)