Every parent's biggest dream is to watch their children achieve their aspirations.

To open the doors of opportunity and to ensure a brighter future for their children, parents dedicate a significant amount of time, money and effort to arm their children with the best education possible.

Given the ever-increasing costs of education, many parents encounter obstacles in preparing for their children's education needs, even more so for those who are planning to send their children to overseas universities.

Wise parents should prepare for their children's education funds as early as possible to ensure their children will be able to realize their dreams in the future.

There are three factors to consider to secure a solid educational pathway for your children:

Define educational goals. Define educational goals.

- 1.Would you like to send your children to a public or private university: will it be in Indonesia or abroad?

- 2.How much time do you have to prepare for your children's university education funds?

- 3.How much money can you set aside on a regular basis to prepare for your children's education funds?

The answers to these questions will help determine the financial plan required to support your dreams for your children's education. |

Create a financial plan.

Compose a financial plan once you have established the likely costs of your children's education funds as early as possible. In addition to helping ensure sufficient funding for your children in the future, early planning provides you with more flexibility to choose the length of your payment plans, reduce the amount required for each payment, and secure the total amount required to cover your child's university education expenses in the future. Create a financial plan.

Compose a financial plan once you have established the likely costs of your children's education funds as early as possible. In addition to helping ensure sufficient funding for your children in the future, early planning provides you with more flexibility to choose the length of your payment plans, reduce the amount required for each payment, and secure the total amount required to cover your child's university education expenses in the future. |

Select the right solution.

Planning for your children's education is complicated, especially with the increasingly hectic pace of life and a myriad of priorities and demands. Select the right solution.

Planning for your children's education is complicated, especially with the increasingly hectic pace of life and a myriad of priorities and demands.

You need the right solution to will help give your children the education they deserve, in addition to preparing a safety net for your children's education funds in the event of any unforeseen personal risks.

College Care gives you peace of mind by ensuring your children's education funds will be available on time and so that they will receive the education needed to achieve their dreams. |

College Care Privileges

- Ease:

Your application will be instantly accepted, without the need for a health checkup.

- Flexibility:

You are free to choose the length of your premium payment term.

- Safety:

You are protected until 85 years of age or until the policy period expires, whichever comes first.

- Convenience:

Premium payments are direct debited automatically from your HSBC savings account.

- Guaranteed:

Funds for education are guaranteed at 255% of the sum insured.

- Security:

In events of unforeseen personal risk the policy will remain effective and the benefits for education funds will be paid out in the predetermined policy years.

- Tailored:

You can schedule the cash benefit payment according to your children's needs.

- Cash Loan ability:

You can make cash fund loan as long as your policy has cash value..

- Tax Free:

Your cash fund benefits are exempt from tax.

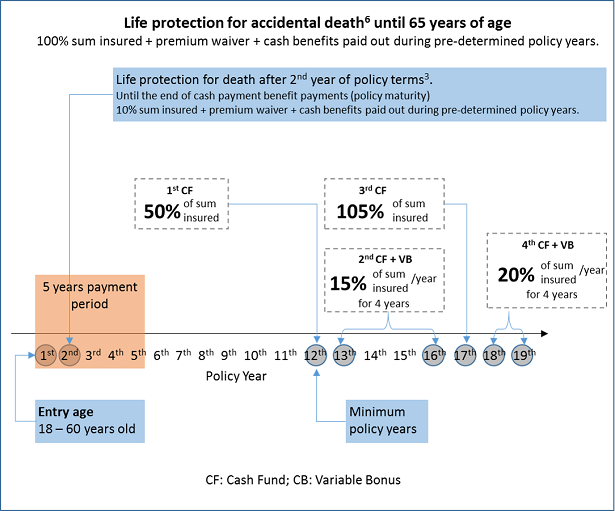

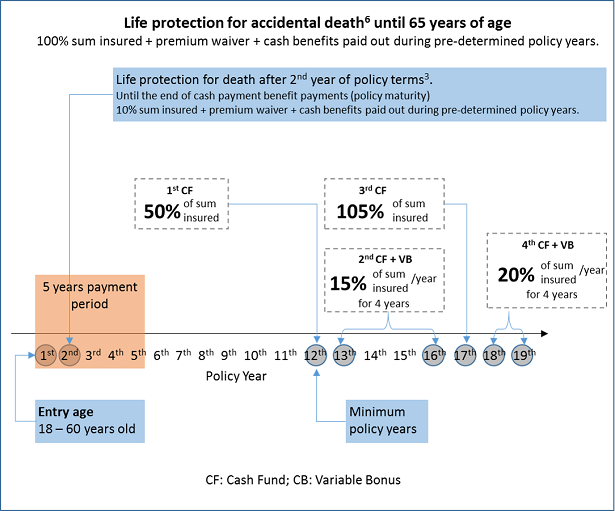

College Care Benefits

Cash Payment Benefits

| 1st Cash Fund |

50% sum insured |

NO |

| 2nd Cash Fund |

15% sum insured |

YES |

| 15% sum insured |

YES |

| 15% sum insured |

YES |

| 15% sum insured |

YES |

| 3rd Cash Fund |

105% sum insured |

YES |

| 4th Cash Fund |

20% sum insured |

YES |

| 20% sum insured |

YES |

Death Benefit

Death benefit after 2nd policy year. (until 85 years of age or policy term expiration, whichever occurs first)

10% Sum Insured (SI) + premium waiver + cash benefits to be paid in the predetermined policy years.Death benefit due to accident. (until 65 years of age)

100% SI (200% SI for overseas accidental death) + premium waiver + cash benefit to be paid in the predetermined policy years.

Benefits illustration for a 5-year payment term, with cash benefits paid out in the 12th policy year

Product Brochure - issued by Allianz

Ringkasan Informasi Produk dan Layanan (RIPLAY) Umum - issued by Allianz

1 Full details of applicable charges are provided in the General and Special Terms and Conditions of the College Care policy. College Care is an insurance product issued by PT. Asuransi Allianz Life Indonesia and not a bank product. Thus, it is not guaranteed by PT Bank HSBC Indonesia and/or any member or members of HSBC Group (HSBC Holdings Plc and its subsidiaries and associate companies or any one of their branches), and is not included in the government's loan guarantee program or deposit guarantee program. HSBC accepts no responsibility for any insurance policy issued by PT. Asuransi Allianz Life Indonesia associated with the College Care program outlined herein. Use of the HSBC logo is subject to the approval of HSBC as a symbol of cooperation between HSBC and PT. Asuransi Allianz Life Indonesia for the express purpose of offering the College Care products outlined herein. HSBC is neither an agent of PT. Asuransi Allianz Life Indonesia nor a broker of any HSBC customer.Return to main text

2 No health examination is required if Sum Insured is 5 billion for accidents and no additional insurance taken. Accumulation of Sum Insured with product Guaranteed Issued previously already owned with Allianz will be applicable.Return to main text

3 In cases where the policy year is less than 2 years and there is risk of death due to a pre-existing condition, then 80% of total premium already paid will be returned and the Policy will end. If death occurs due to no pre-existing condition, then the waiver of premium and benefit of the cash fund will remain and be paid in the specified policy year.Return to main text

4 The policy loan will be subjected to multiple interests according to the provisions in Allianz, maximum loan is 80% of the cash value of the policy and if there is no unpaid premium.Return to main text

5 Non-Guaranteed Cash Value (Variable Bonus) will be paid one year after the 1st year Cash Fund and will only be paid if the policy is surrendered and insurance ends. The amount of Variable Bonus is not guaranteed.Return to main text

6 Additional Accident Protection Benefit. This benefit applies to the risk of accident and death during the period of travel outside of Indonesia (200%) and within Indonesia (100%) for no longer than 90 days after the date of departure. This benefit is in addition to the Death Benefit.Return to main text