HRSA Bonus Rate

Period program: 1 April - 30 June 2025

|

Average Balance Increase (Rp)

|

% Basic Interest (per year)

|

% Interest Bonus (per year)

|

|

100 Million - ≤ 2 Billion

|

2,75%

|

2,50%

|

|

>2 Billion - < 5 Billion

|

3,25%

|

2,00%

|

|

≥ 5 Billion

|

3,75%

|

1,50%

|

Criteria:

- Valid for customers who already have an HRSA account or have just opened an HRSA account.

- The bonus rate is calculated based on the increase in the average monthly balance in the HRSA account, starting from IDR 100 million.

- The baseline for calculating the increase in the average balance is the average balance in December 2024.

- No participation form is required. Customers only need to add funds to their HRSA account to get the bonus rate.

Program Mechanism & Terms

- "Average balance increase" is calculated from the Average balance in HRSA accounts during the program period compared to the average balance in the month prior to the program period (December 2024 Baseline).

- An increase in the average balance of at least IDR 100,000,000 (one hundred million rupiah) in the HRSA account during the Program Period will receive additional interest according to the following tiering of the average balance increase value.

- The interest bonus will be automatically credited to the Customer's HRSA account if the minimum average balance increase is met, credited no later than 10 calendar days in the following month.

- The provisions of HRSA products and the provisions of other investment products still refer to the product features applicable at PT Bank HSBC Indonesia.

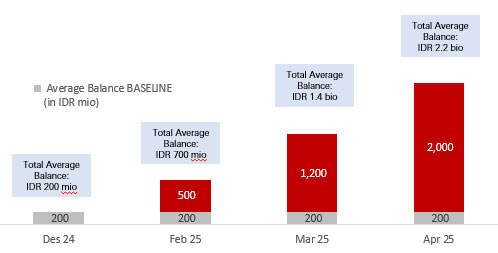

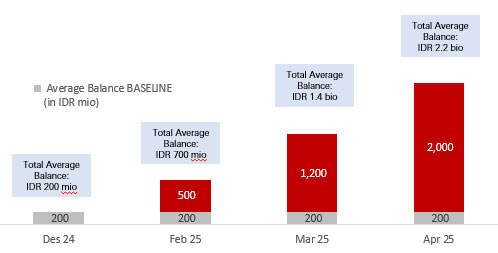

Program Illustration

- The average balance is calculated by adding the daily balances in the HRSA account divided by the number of days in the current month.

- The average balance increase is calculated from the Average balance in the HRSA account during the program period compared to the average balance in December 2024.

Illustration

| Promotion Month |

Incremental Average Balance Calculation (Rp) |

| April 2025 |

700 Mio - 200 Mio = 500 Mio |

| May 2025 |

1.4 Bio - 200 Mio = 1.2 Bio |

| June 2025 |

3.2 Bio - 200 Mio = 3 Bio |

Bonus Interest Calculation:

April: 500 Mio x 2.5% x 30 days / 365 = 1.027.397

May: 1.2 Bio x 2.5% x 31 days / 365 = 2.547.945

June: 3 Bio x 2% x 30 days / 365 = 4.931.507

Customers still get basic interest for all increases in the average balance in the illustration above.

Program terms and conditions can be seen here

Interest Rate

|

Balance

|

Interest Rate

|

|

0 - < IDR 5 mio

|

0.00%

|

|

IDR 5 mio - < IDR 100 mio

|

1.00%

|

|

IDR 100 mio - <= IDR 2 bio

|

2.75%

|

|

> IDR 2 bio - < IDR 5 bio

|

3.25%

|

|

>= IDR 5 bio

|

3.75%

|

Interest for HSBC High Rate Savings Account is calculated daily based on the daily balance using the daily interest rate (annual interest rate divided by 365 (three hundred sixty five) days). The interest charged is the accumulated interest that is calculated on a daily basis based on interest calculation cycle*. Zero (0%) interest will be applied to the Customer's HSBC High Rate Savings Account on the days wherein the Customer's account balance is below IDR 5,000,000 (five million rupiah)

Penalty

Customers who perform any regular debit transaction such as time deposits placement, payment or transfer (excluding the ones related to tax, fees, and/or charges in the Bank) more than ten times or investment placement (mutual funds, bonds and/or insurance) more than five times in one month* from their HSBC High Rate Savings Account:

- No interest for that month.

Transaction accessibility through various channels:

|

HSBC Indonesia Mobile Banking

|

- Balance Inquiry

- Account Opening

- Transfer from HSBC High Rate Savings account to another HSBC Account

- Real-time online transfer

- RTGS and SKN

- Telegraphic Transfer

- Mutual Fund Subscription

- Deposits Placing

- Standing Instruction (PIB Only)

- Payment (Telecommunication, Cable, Utilities)

- Cellphone Minutes Top Up

|

|

HSBC Branch

|

- Cash deposit or transfer into the HSBC High Rate Savings account

- Account Opening via PIB in Branch

- Any other transaction not available

|

|

Others

|

- Composite Statement available

- IVR and Phone Banking not available

- Passbook not available

- Minimum placement from Rp 1.000.000

- Limited to one HSBC High Rate Savings account per customer

|

* Interest calculation cycle and number of transactions per month are calculated from current month's credit interest date to one day before the following month's credit interest date. If the credit interest date falls on a holiday, the calculation will be postponed to the next working day. The credit interest date is on 26th every month, therefore the interest and number of transactions calculation is between the 26th of the current month to the 25th of the following month.

- How will HSBC High Rate Savings help me in my life?

- HSBC High Rate Savings supports your vision to save and rewards you with a higher interest rate than your regular savings account, making it an attractive, more liquid addition to diversify your portfolio.

- With its online capability, you are able to access, manage and execute desired transaction anytime and anywhere via HSBC Indonesia Mobile Banking.

- Thinking of investing, but market conditions are not yet conducive? With its higher interest rate, HSBC High Rate Savings is a perfect pit stop to save up prior to purchasing any of our investment instruments.

- What do I need to do to enjoy the high interest rate?

To enjoy the high interest rate you must ensure:

- That your HSBC High Rate Savings balance starting from IDR 5 million .

- To not perform any regular debit transaction such as time deposits placement, payment or transfer (excluding the ones related to tax, fees, and/or charges in the Bank) more than twice or investment placement (mutual funds, bonds and/or insurance) more than five times in one month* from your HSBC High Rate Savings Account.

If you fail to satisfy the criterias above, you will not receive the interest for the month.

- Do I need to have an HSBC bank account before applying for HSBC High Rate Savings?

Yes, you must open a separate HSBC account with us first and register to our PIB service prior to applying for HSBC High Rate Savings.

- Can I use HSBC High Rate Savings for debit card/ATM transaction?

No, you will not be able to perform any debit, payment or transfer transaction through debit card/ATM, as HSBC High Rate Savings will not be able to be connected any debit card and is an online-based account.

- Can I open more than one HSBC High Rate Savings?

No, you are not allowed to open more than one HSBC High Rate Savings.

* Interest calculation cycle and number of transactions per month are calculated from current month's credit interest date to one day before the following month's credit interest date. If the credit interest date falls on a holiday, the calculation will be postponed to the next working day. The credit interest date is on 26th every month, therefore the interest and number of transactions calculation is between the 26th of the current month to the 25th of the following month.