How do I make a Financial Plan?

To maximise the potential of your wealth and reach the goals you have set for yourself in life, it is very important to have a financial plan. We often hear of how many people consider financial planning to be a complicated task, but if you break it down into a few easy steps, it becomes the guiding light toward your successful financial future.

Let us support you through the 5 easy steps for financial planning:

Step 1: Set clear goals

Set clear short–term and long-term goals, which may range from:

- Paying for your home.

- Buying property, whether domestic or overseas.

- Starting your investment portfolio, both for your family's future and for the increase your own wealth

- Providing the best education possible for your children.

- Preparing your retirement fund which will allow you to live comfortably in years to come.

It's pretty common to re-consider and talk over your financial goals every 6 months when you create your first financial plan. This is to maintain your focus on what is important and to arrange your priorities and commitments so you can give your best shot at meeting your financial targets.

Step 2: Assess your current financial situation

Before meeting with a financial advisor to discuss your financial plan, it is important to take a look at your current financial situation so that the most appropriate plan can be put together that is tailored to you. Is essential that you make an analysis of the following:

- Household Expenses:

- What are your monthly household expenses?

- How does your household expenditure this month compare with that of last month?

- How much you can afford to set aside for savings and investment?

- Ownership of Assets:

- Do you have savings?

- Are you investing?

- Are you covered by insurance?

- Financial Commitment:

- Are you prepared to set aside funds for investment each month and make it routine?

- Will you be able to cover compulsory household expenses on time?

- Family:

- How many children do you have now or plan to have in the future?

- How many grandchildren do you have and do you have any financial commitments to them?

- Do you have school age children who will one day require a university education?

- Future Plans:

- Will you purchase property or add to your property portfolio?

- Will your children require further education?

- How will you assist your children when they decide to get married?

Step 3: Draw up your Plan

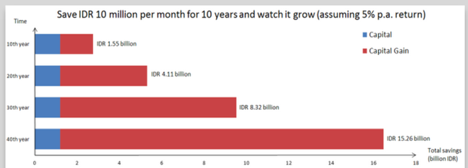

Now is the time to save and start investing. We have an entire range of savings and investment options to suit your needs from deposit accounts, to shares, to bonds, to property and right through to investment funds. Whichever you choose, please consider the following:

Understand the Risk of your Investment Choice

Every investment type has its own character and risk. As an investor, get to know what level of risk you are comfortable with and understand the risk profile associated with your investment choice, including all the factors which bear influence on your investment.

Make sure that the goal of your investment is realistic in terms of your expectations and current financial situation. If you need to, employ the services of a financial advisor to select the type of investment that will work best for you.Your Investment Objectives

- Capital growth: Before increasing the value of your original investment, understand the level of risk that you are likely to face.

- Income: Investing can be a great way to add a source of continual income, for example when bond dividends are shared or investment interest is paid to you.

- Capital preservation: If you are just looking to protect the value your principle investment, choose a deposit account or an investment product where the financial risk or the return tends to be lower.

Liquidity

If you were to suddenly need cash at any given moment, does your investment easily allow for you to cash-in?

Consider the pros and cons of each of the points above, and come up with a monthly investment target that is realistic for your situation and lifestyle.

Step 4: Put your Plan into Action

Putting your strategic financial plan down on paper is not enough- you need to put your plan into action. Congratulate yourself for taking the first steps toward investment and if you need to, consult with a financial planner to help guide you toward your investment goals.

Step 5: Review your Financial Plan regularly

Market fluctuations are always bound to occur. With the support of the HSBC financial team, your investment portfolio will be monitored regularly to ensure that it remains in line with your investment goals, and can withstand any market volatility.

Need our Assistance?

One of the best ways to ensure a good investment portfolio is to choose the right financial advisor. Our financial advisors can recommend savings and term deposits, investments, and insurances that are appropriate to your current financial situation while ensuring that your future plans and financial goals are made priority.

Click here to arrange for one of our HSBC team members to contact you.